Investor's note

Tom’s experience scaling a small business exposed him to the pains of payment processing — for something so integral to growth, the tools available were severely lacking.

When he later switched gears to Head of Finance Operations for a multinational corporation, it underscored how much small businesses were at a disadvantage. He knew what he had to do next: bring enterprise-scale payment processing to Mom and Pop’s. From there, Comma was born.

We sat down with Tom and discussed his artistic roots, his winding career path, and how On Deck empowered his vision for the future of payment processing with his start-up Comma.

Small business owners don’t go into business to spend endless hours on accounting and payment processes, but that’s what many of them are doing. Accounting has been something that’s relatively easy to outsource, but doing the same with payments has remained problematic.

Tom Beckenham experienced this first hand as an entrepreneur and then got to see how the other half lives: enjoying corporate banking solutions and payment systems while handling operations for a large multinational corporation.

Inspired by what he learned, Tom founded Comma to simplify payment processes and give business owners their time back. He sat down with us and shared his artistic path to entrepreneurship, Comma’s evolution and future, and how it all came together at On Deck.

Note: This is part of a series where we talk to On Deck Founders alumni about the companies they’re building and what it will take to propel them to the next level. Consider joining our incredible community of founders who have launched over 1000 companies worth over $9B. Apply here.

Entrepreneurship is creative work

Tom began his career in the arts. A sculpture major and aspiring filmmaker at the College of Fine Arts in Sydney, he learned to code when he started experimenting with animation. After switching majors to computer graphics, Tom dove into game design and character animation, inspired to create movement through algorithms and plug-ins. This would go on to change the course of his career.

After graduation, he landed at Adstream, a creative advertising company, where he eventually moved into management. He founded his own company, Specle, providing software to advertising professionals. With Specle, Tom made every mistake a founder could: he started his first company in a sector he wasn’t familiar with, in a country he had only recently emigrated to.

Reflecting on those years, he said, “The first years were a bit tricky. I did a lot of things wrong, but eventually I made it work.” One of the things Tom had to “make work” was the salary and expenses payment process, which was a major time drain. He carried on with the thought that the process was just part of running a business, there certainly weren’t available solutions to change it. Despite the painful payment process, Specle was a success and Tom sold it to an investor, freeing himself up to continue on his unique professional path.

There are hundreds (maybe even thousands) of stories about entrepreneurs who “make it work” against all odds, but the reality is often much starker than these feel good stories. Something like 90% of start-ups fail, and even very successful ones don’t always have picture perfect paths to sustainability. So what helped Tom become an outlier, in spite of all of the mistakes he made? He credits his creativity.

Introduction to big business payment solutions

Next Tom took the time to help a friend build out the technical side and team at MurphyCobb & Associates (MCA), a global advertising production consultancy. Taking the lead of finance operations is where Tom was introduced to the complexity of international financial and billing processes and to the solutions available to large corporations.

Tom noticed that even though the financial transactions were extremely complex, a lot of the needed work was happening in the background without causing the company much trouble. He realized that at a big enough scale companies get access to corporate banking and systems that, even if clunky, manage suppliers and handle bulk payments. The comparative ease and speed of the same processes was striking, but only a fraction of the world's companies could take advantage of those products and services. He certainly couldn’t while building Specle.

“The smaller you get, the less you have. By the time you get down to very small companies, in the US, they're sending checks; in the UK, they're copy-and-pasting from payslips into their bank account one by one, paying things manually. It's a time consuming, laborious, painful process. And there just hasn’t been a way to automate it. It's been assumed that nothing can be done until those businesses are bigger.”

Making it work: experimenting toward a solution

Not one to shy away from bold moves, Tom set out to create big-business inspired solutions for small companies. With the mission in mind, Tom tested several approaches to affect various aspects of the payment process.

The best approach came from combining the learnings from the previously tested approaches with hundreds of conversations with finance professionals. Tom understood that Comma could bridge the gap between payment setup and payment execution.

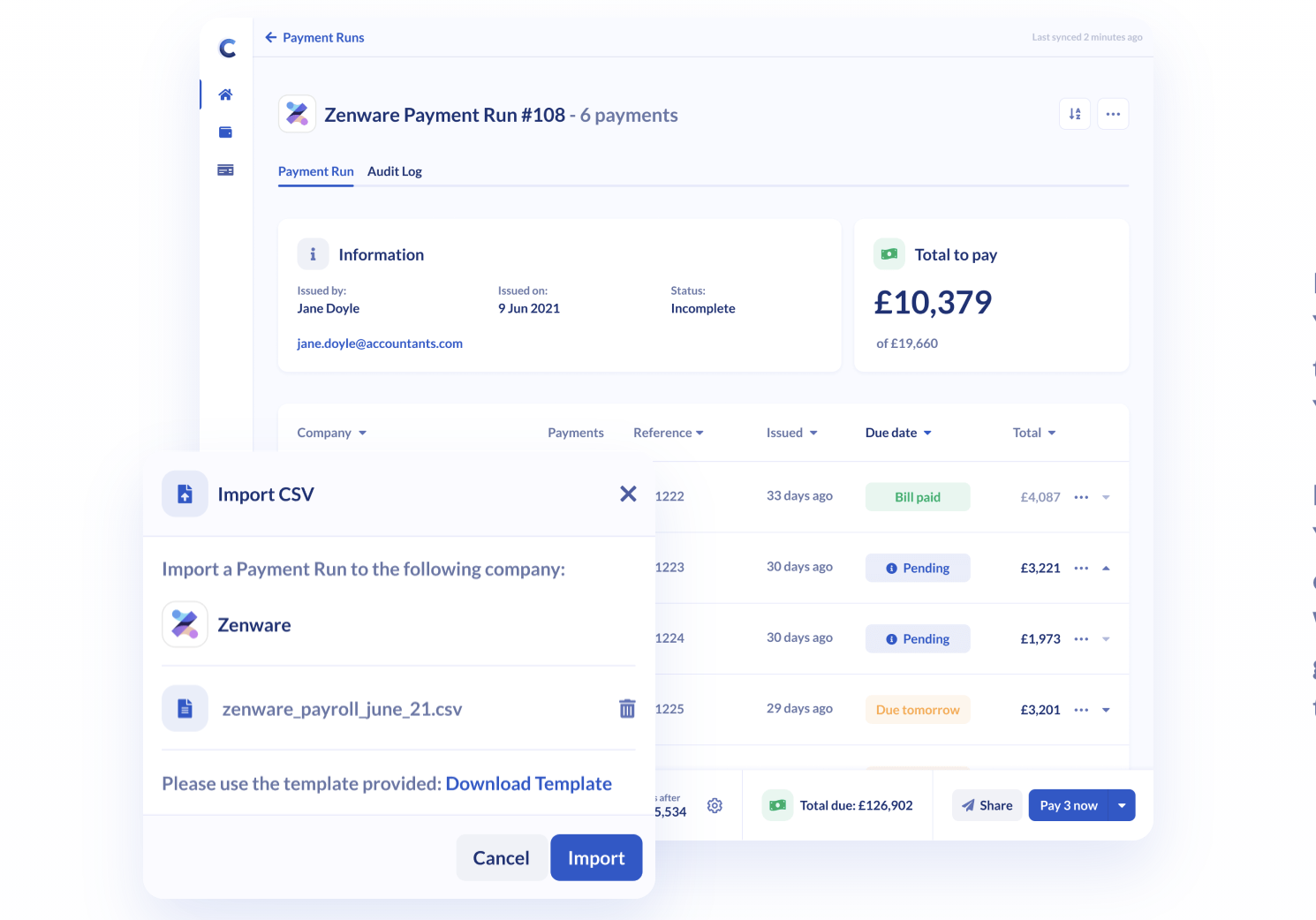

“With open banking and direct API into banks to initiate payment, we would allow an accountant, bookkeeper, or a service provider to create a payment run that could then be executed by the business. Then you create this magic service where the client gets a button to click. They can pay for everything in one click.”

Comma enables businesses to outsource the payment setup but execute the payments themselves avoiding the need for opening new bank accounts, adding external partners to bank mandates, or increasing liability insurance costs.

Guidance for founder life at On Deck

The next stage of Tom’s founder journey kicked-off when he met Anne Dwane, co-founder and partner at Village Global. The meeting catapulted Tom’s efforts and led to other key introductions, including Peter Briffett and Portman Wills of Wagestream.

With a pre-seed round, a product he could demo, and a pricing model that had buy-in from potential customers, Anne’s sage advice landed Tom in On Deck Founders Fellowship.

Tom’s creative thinking had gotten Comma to a stage of massive potential, On Deck helped him expand the hard skills and network that would be needed to execute on it. Tom valued the new network of individuals who could share insights into their own entrepreneurial journeys. Candid discussion in the weekly Mastermind group about the success and struggles of being a founder made the sometimes trying aspects more manageable. In fact, for Tom those connections makeup a part of his support system beyond the ODF program. “The knowledge and experience and the depth and variety of people in On Deck was what made it so magic,” reflects Tom.

The Fellowship’s programming provided Tom with applicable knowledge for the next stage of Comma’s growth—fundraising. He was able to leverage connections made at ODF organized VC dinners. Meanwhile, Mike Wilner’s approach to early-stage funding served as Tom’s playbook when raised a $6 million seed round. The fundraise was led by Octopus Ventures and Connect Ventures, who were joined by Village Global, and the founders of Wagestream, Peter Briffett and Portman Wills.

The future of painless payments

Armed with his network and knowledge from On Deck and with an influx of cash to accelerate Comma’s mission, Tom’s first focus was growing the team. From the advice of seasoned founders and On Deck colleagues, his first hire was a Head of Talent. This has enabled the team to scale with individuals of incredible depth of skill and experience.

“Bringing on great people is the first task. We brought in the Head of Talent immediately. It's made a huge difference in just how we present ourselves as an employer and how we draw talent. We have attracted some amazing candidates and we're confident in the team we’re building.”

On the product side, Comma is rapidly expanding in payments volume, which is growing exponentially. But as Tom points out, there is still a lot to prove.

With the rapid volume growth they’ll be ensuring that engineering can execute on a product to handle the new scales. There will also be focus on leveraging the relationships and clients they already have. First they’d like to see how quickly they can expand through those accountants’ client bases. They’ll also be tracking payment patterns to better understand where to build out the product.

Since Comma’s mission is to ease payment processes for small businesses, it’s focused on a solution that doesn’t require clients to open an additional bank account. That means that for now, Comma’s market is primarily the UK, where open banking through API connectivity to accounts is readily available. As the wave of opening banking flows to other countries, Comma will expand to those markets.

Next on the horizon is Germany; although they’re expecting countries like Spain, Italy, France, Japan, Australia, and Canada to follow suit. Tom is laser focused on creating an exceptional product to be a magic button payment solution for small businesses, no matter which market opens up next.

//

Comma is hiring, check out their jobs page here.